Traditional lending programs are not always able to provide financing to nonprofit organizations. Unlike for-profit businesses that can show a steady income stream, nonprofit organizations are not always able to show that and often service clients who cannot afford to pay for services. Traditional frameworks may determine your engagement with government, foundations and individuals for grants and donations as a weakness. These may be viewed as unreliable because of the uncertainty of these funding options and the timing of receiving them once approved.

We can help you turn your funding support network into a strength by showing them ways to fund the valuable services you provide beyond donations.

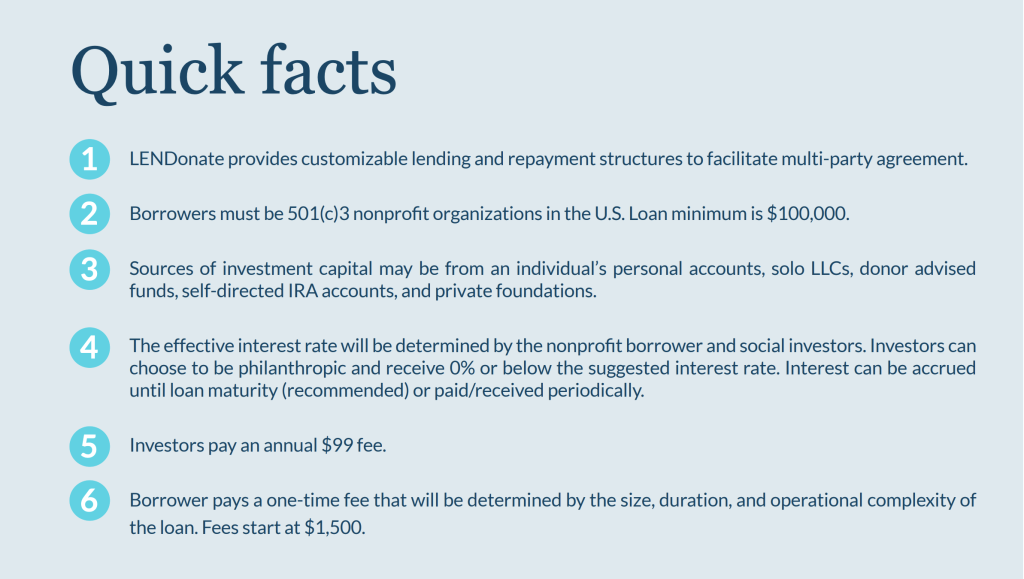

Through LENDonate’s BYON program, we can help your nonprofit design a program to raise private loan capital. The investments would come from your nonprofit’s network of supporters – people on your leadership team, board members, and major donors. Loan terms are flexible and can have special features such as a loan-to-donation conversion option.

Please download the brochure and reach out with any questions. We would be happy to schedule a 30-minute complimentary consultation call to explore whether BYON would be a right fit for your organization.

These custom private loans help both nonprofits and their supporters achieve their respective goals. For the nonprofits, this provides access to affordable capital immediately to be used for real estate purchase, program expansion, organization turnaround, and more. Supporters of the nonprofit can expand their support beyond donations and choose to receive a return on their investment. Optional loan features can be customized to include interest rate reduction, loan forgiveness, impact milestones, and more, if both parties agree.

All investments are offered under Rule 506(c) to Accredited Investors as defined in Rule 501(a) of Regulation D of the Securities Act of 1933.

Can the nonprofit customize the terms?

LENDonate and the nonprofit would work together to customize terms that we believe will align with the interests of the nonprofit and investors, taking into consideration the size of the need, investors’ capacities, timelines, and desired outcomes.

Can LENDonate match me with investors and donors?

No. Unlike our Marketplace loan offering, for the LENDonate BYON Program, you must bring your own supporters. LENDonate can provide communication support once we are introduced to your supporters.

If this is a private loan with our own supporters, couldn’t we just do this ourselves?

While there are some cases in which borrowers and supporters can handle it themselves, there are advantages to having LENDonate, an independent party, facilitate the transactions, e.g., standardizing agreements with multiple investors. Other times, it may be required by the financial custodian, e.g. funds are within a donor advised fund.

What if we are not ready to repay the loan at maturity?

A loan modification and/or extension may be considered if agreed upon by all investors.

Schedule a 30-minute complimentary consultation call to explore whether BYON would be a right fit for your nonprofit organization.

Share this page

A password will be e-mailed to you.