"The motivation behind starting LENDonate was to test our theory that we can combine investments and philanthropy to leverage greater impact. I’m happy to report that early results indeed indicate that."

Vivienne Hsu, CFA, Founder & CEO of LENDonate

"The motivation behind starting LENDonate was to test our theory that we can combine investments and philanthropy to leverage greater impact. I’m happy to report that early results indeed indicate that."

Vivienne Hsu, CFA, Founder & CEO of LENDonate

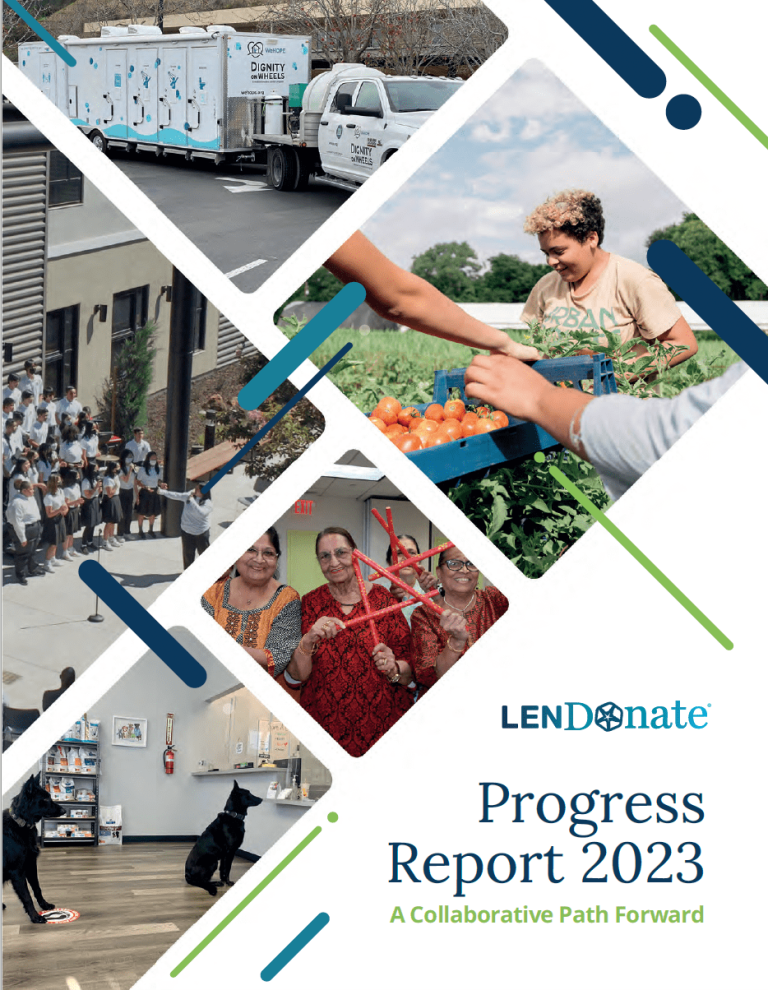

When I started LENDonate in 2015, I wanted to build a more collaborative financial ecosystem for the nonprofit social sector – to empower mission-driven organizations with the tools and techniques of the investment sphere. And as our Progress Report demonstrates, this marriage of investment and mission has proven to be powerful.

Not only have we helped our nonprofit partners meet their mission goals, but we have also provided investors with a direct way to expand their scope of impact. We want to shine a light on the undiscovered, underdeveloped opportunities in the nonprofit financial system and explore the range of motivations of our investors, whether that is social impact over investment return or the reverse.

We are fortunate to witness the social sector in action every day, and over the past years, we have enabled numerous unique projects to succeed. These nonprofits have met our rigorous credit underwriting requirements and their compelling missions are thriving by partnering with investors through our platform.

Through the select stories in this report and the data we have compiled, we hope to illustrate the leverage impact we can create while giving nonprofits more financial flexibility. We look forward to expanding our social investments through collaboration and innovation in this critical social sector.

Vivienne Hsu, CFA

Founder & CEO

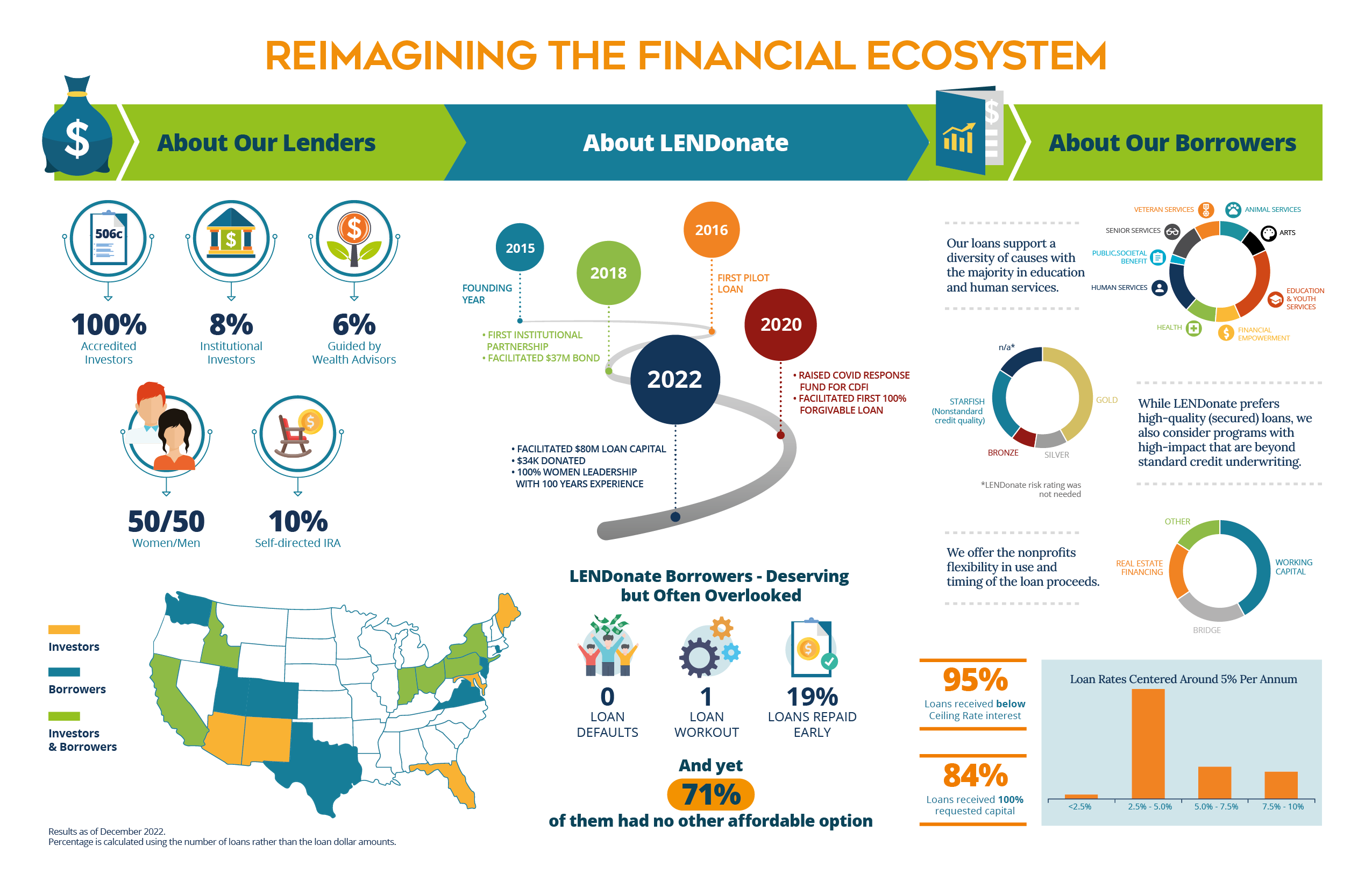

The centerpiece of LENDonate’s approach is to acquire impact funds from investors to generate loan capital for nonprofits (NPOs). This nonprofit debt-financing market is neither new nor small; the Federal Reserve reported $528 billion in debt¹ held by NPOs as of December 2022. What is new, though, is the desire to connect the two spheres of impact investing and philanthropy without compromising either goal. Yet, remarkably, traditional lenders rarely design lending programs or credit underwriting models specifically with nonprofits in mind. There is a general misconception that lending to nonprofits bears higher risk. This is not always true. In fact, to date, LENDonate has had zero² loan defaults.

1. Nonprofit borrowers apply and share their stories and financial documents.

2. LENDonate, assesses each borrower’s creditworthiness and assigns an appropriate interest rate (ceiling rate) to qualified loan requests on the Marketplace. Through a bidding process, the Marketplace prioritizes investor offers that are more favorable to the borrowers. Offers may include loan bids at the ceiling rate or at an investor-reduced rate, a pure donation, or loan+donation.

3. During the life of the loan, LENDonate services the loan by attributing monthly repayments back to each investor. LENDonate also facilities an investor-initiated loan-to-donation conversion at no cost, such that 100% of converted funds go to the nonprofit borrower.

4. With repayments back in investors’ accounts, they can recycle the funds to other worthy causes!

The result is everybody comes out ahead. Nonprofits receive much-needed funding for critical campaigns from a wider community of supporters. Investors select from a broader set of investment opportunities supporting worthy causes. LENDonate is the next generation impact investment.

Like all businesses, having access to credit is essential for many NPOs to execute their missions. Without affordable loan capital, nonprofits may have to forgo growth opportunities, operate in suboptimal real estate space (or pay high rent), or consider predatory loan options.

Nonprofits use borrowed funds to:

Approximately 87% of nonprofit debt is used to finance real estate, making this the most common use of a loan by nonprofits. This isn’t surprising, since most NPO programs and services are place-based and local to their communities. NPOs often need timely financing to compete for attractive properties, and a good property can make a huge difference in their overall success.

When an NPO program is successful, demand for their services will increase, just as it might for a small business. But unlike small businesses, NPOs’ access to growth capital or seed capital to finance expansion is limited. Availability of bridge-to-grant loans or working capital loans allows

Many government grants are available on reimbursement systems, where NPOs first perform work (and incur costs) and then bill the government or other program sponsors. Government receivables especially are notorious for not being on time, and access to bridge loans can greatly mitigate inevitable cash flow fluctuations.

By focusing on these loans for creditworthy nonprofits, LENDonate

The expanded relationship with nonprofits has also proven to be a benefit for the impact investor seeking a double-bottom-line return (i.e., financial and social ROI). Of course, loans are not a replacement for grants and donations; rather, they can provide leverage that can amplify their impact. Donors can further their investments to align with NPOs’ social mission, especially when the investment capital is used by NPOs.

Some investors prefer not to blend the two disciplines as they may have their own investment frameworks. LENDonate offers them a way to invest at market rate because they don’t have to be philanthropic minded to benefit from our approach. Our investment notes fund impact, but they also provide a return of principal and with interest. The LENDonate Risk Rating of each note is visible, which allows investors to select their own risk/reward tradeoff and enhance the overall diversification of their portfolio.

But perhaps most importantly, a successful loan puts money back into the impact investor’s pocket. Those restored funds empower them to make additional investments in the future. Providing NPO loans has a kind of leverage that donations alone cannot hope to equal.

Irina T.

Lending since 2016

Did we help drive more financial access for NPOs and lower their cost?

Did our borrowers become financially stronger? Were they able to meet their goals? Were they saved from staff reduction and/or closure?

Did our investors achieve their personal double-bottom-line goals?

Footnotes:

¹ Federal Reserve Statistical Release: Financial Accounts of the United States Second Third Quarter 2022,” Board of Governors of the Federal Reserve System

² Default is when a borrower does not make the required payment on his debt. Occasionally, the lender offers a payment reprieve if the situation is deemed temporary. LENDonate currently has one loan that falls under this classification.

Share this page

A password will be e-mailed to you.